Consumer Pulse: a weekly look at what’s shaping shopper behavior

DISCLAIMER: The information contained in this blog post is intended for general informational purposes only and does not constitute legal, financial, or professional advice. Please seek appropriate professional counsel before making any decisions based on the information provided.

For brands across retail and hospitality, economic volatility is creating daily pressure to make the right decisions.

At Klaviyo, we’re hearing the stress firsthand: brands are being asked to do more with less, while trying to make sense of shifting consumer behavior in real time.

So we’re launching Consumer Pulse: a weekly snapshot of what consumers are thinking, feeling, and doing right now. Each week, we’ll share fresh research on what’s driving purchase decisions and how those behaviors are evolving—so B2C marketers can make smarter, more strategic choices about everything from pricing to messaging to retention.

Because when it comes to earning share of wallet, especially in uncertain times, the brands that win are the ones that truly understand their customers.

This week’s pulse: sales are heating up—and so is support for domestic brands

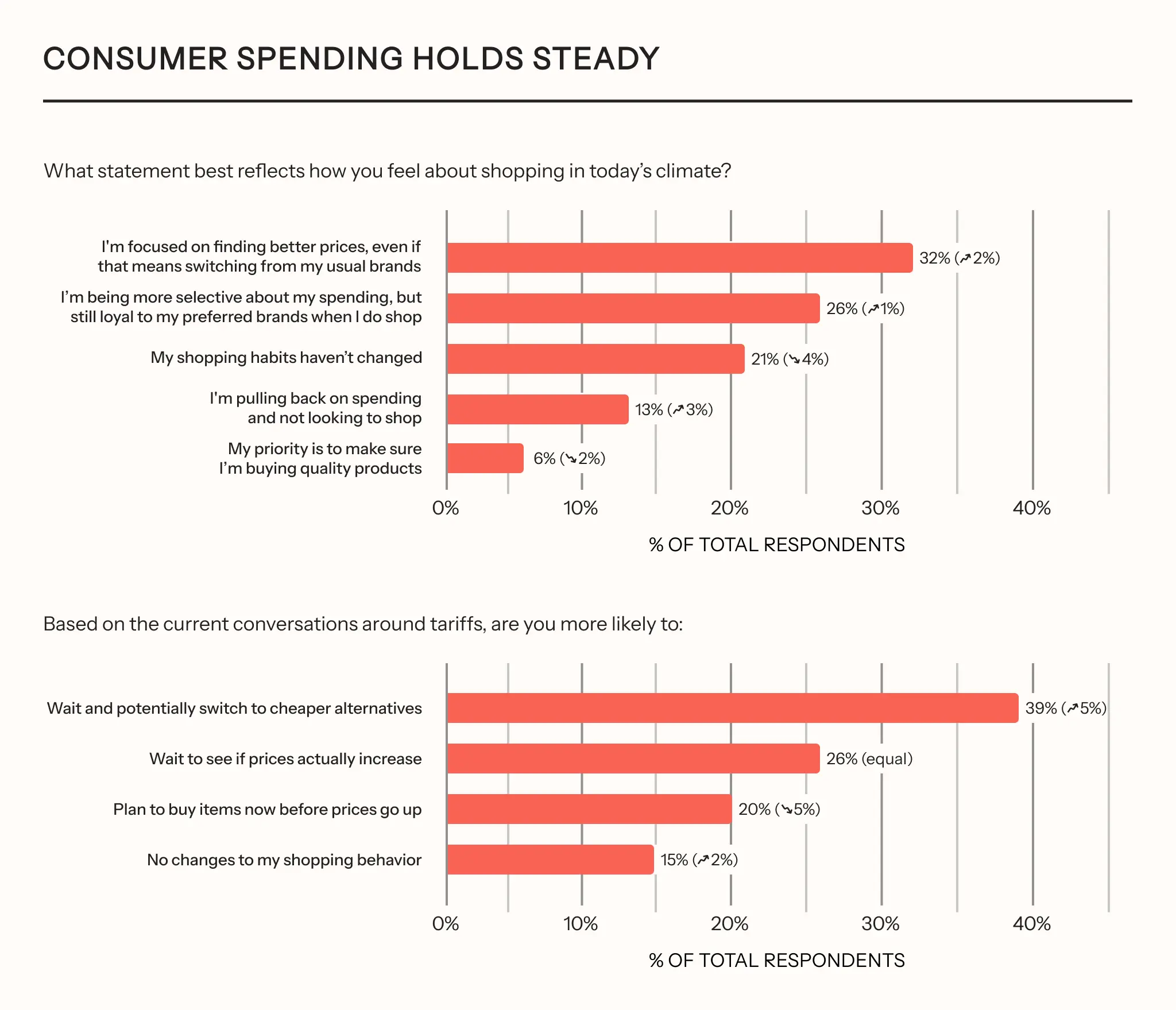

Consumer spending sentiment stayed fairly steady this week, but two new signals are worth your attention. A meaningful slice of shoppers are spotting unusually deep promotions, and interest in buying American-made products is climbing—creating fresh opportunities for brands ready to act.

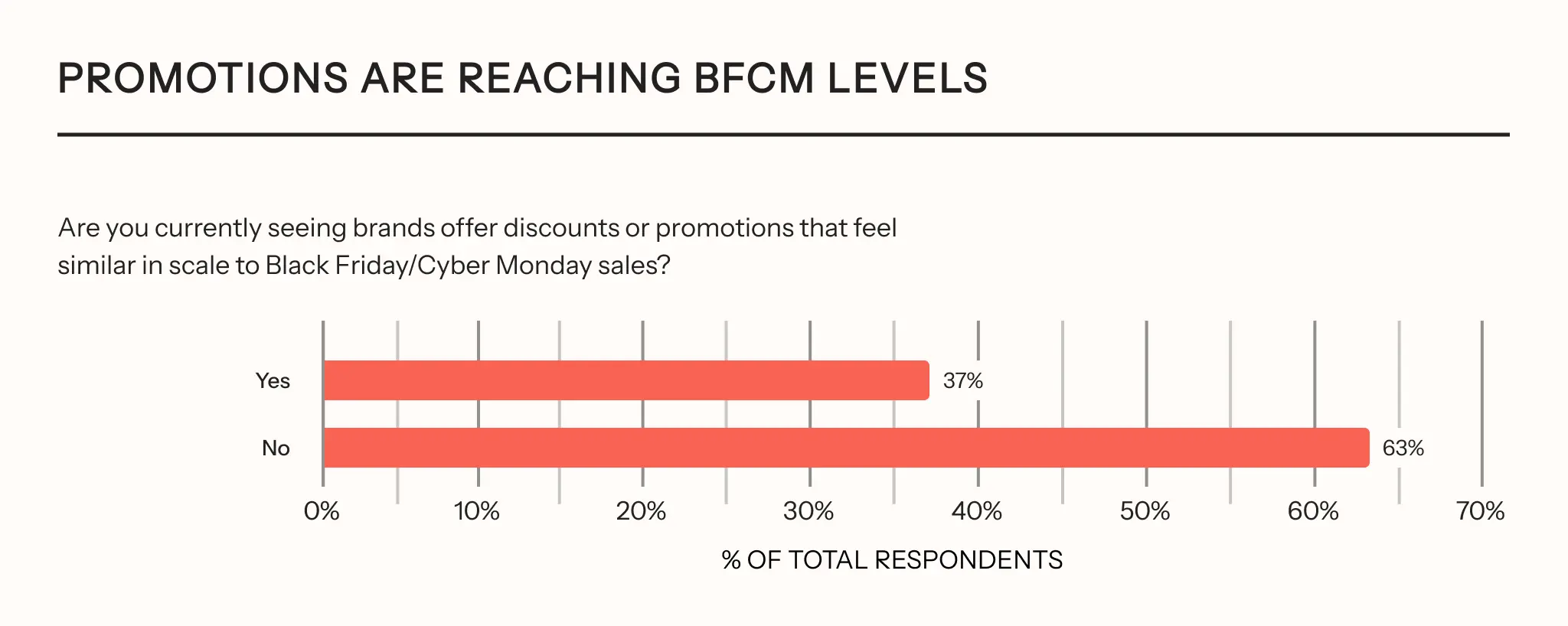

Consumers are seeing BFCM-level discounts and promotions

First, promotions are everywhere—and consumers are taking notice. Nearly 4 in 10 shoppers (37%) say they’re seeing Black Friday-level discounts and sales right now, as brands race to respond to rising price sensitivity and tariff concerns.

While these promotions are helping brands maintain momentum, they also hint at bigger questions ahead: will brands have enough inventory left for peak holiday periods?

If you’re offering steep discounts today, it’s worth taking a strategic look at how you’ll balance pricing, inventory, and consumer expectations through the end of the year.

Consumers are seeking out “Made in the USA”

Second, domestic shopping is gaining steam. In response to tariff concerns and supply chain uncertainty, 42% of consumers say they are intentionally seeking out American-made products.

It’s a clear signal that “Made in the USA” messaging could resonate more strongly this season, particularly among shoppers eager to support local businesses and avoid international shipping delays.

Together, these trends suggest that while price sensitivity remains a dominant force—77% of consumers say price is their top purchase driver—other factors like brand trust, shipping speed, and even the origin of goods are starting to weigh more heavily in decision-making.

What marketers should do

For marketers, the takeaway is simple: stay agile.

- Lean into real-time signals to refine your messaging and promotions.

- If you’re running sales, pair them with stories that emphasize value, trust, and transparency—not just discounts.

- And if you source or manufacture domestically, don’t be shy about sharing that with your audience.

In uncertain times, customers are telling us exactly what they value. Brands that listen—and respond with clarity and care—will be the ones that win loyalty for the long haul.

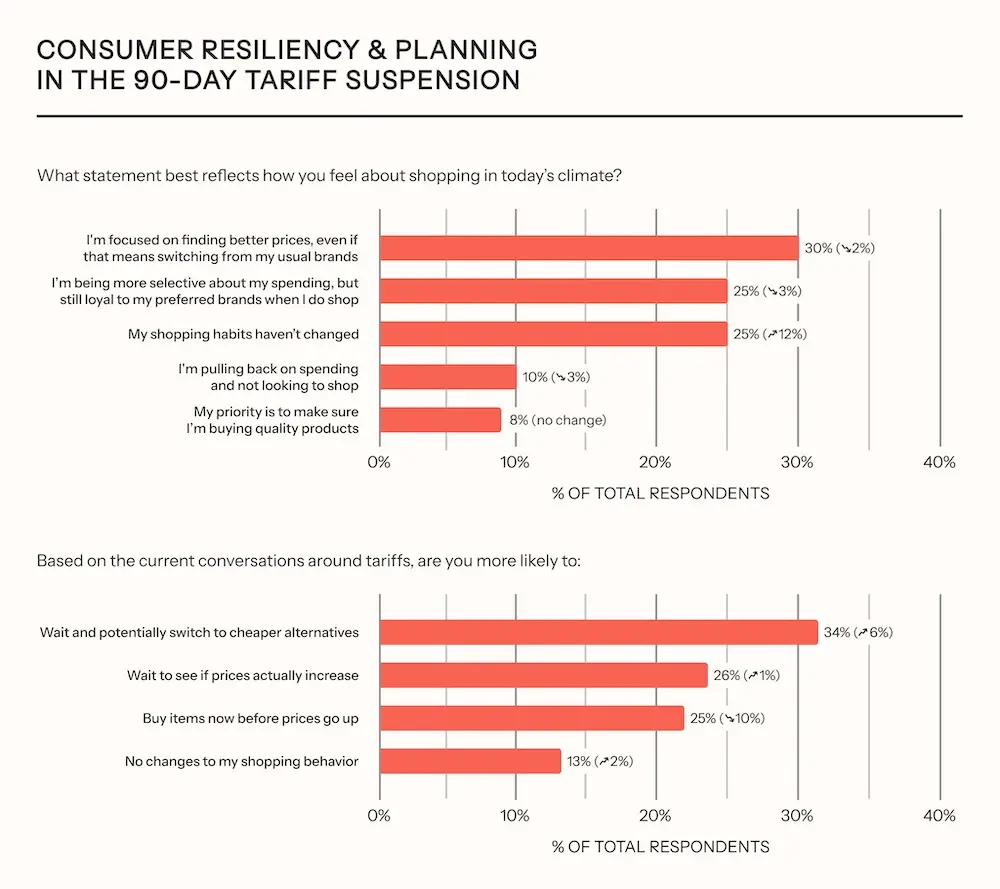

Week of April 21: caution is rising and your competitors are moving—are you ready to respond?

New survey data shows consumers are growing more hesitant in the face of tariff chatter and economic uncertainty—but they’re not disengaging. They’re scanning the road ahead, weighing options, and holding brands to a higher standard before making a move.

For marketers, that means one thing: now is the time to earn trust, not just clicks.

Let’s look at the signals.

Fewer shoppers are rushing to buy before prices go up

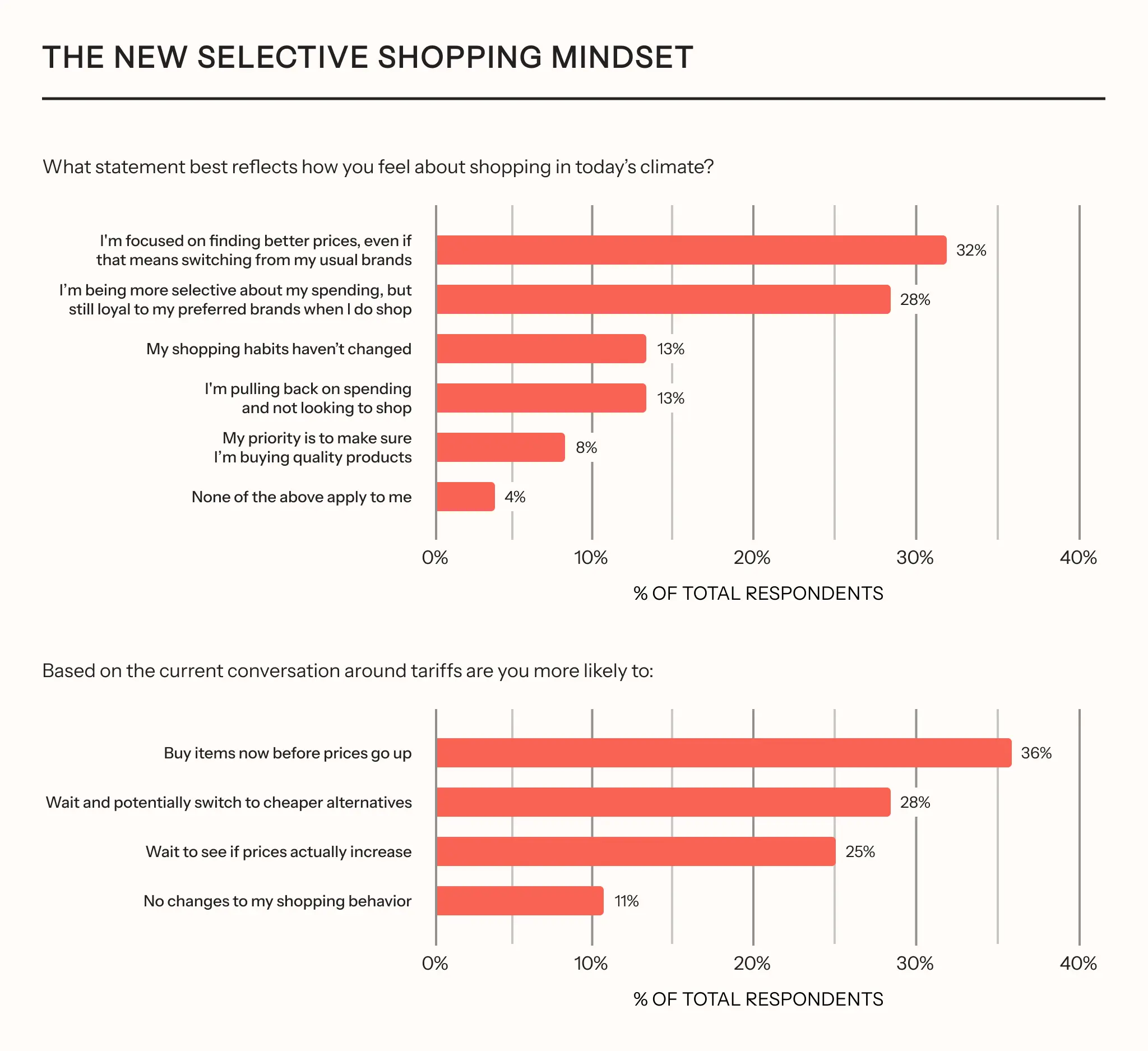

Just 25% of consumers are rushing to buy this week before prices go up, down 10 points from the last survey. Instead, more are adopting a wait-and-see approach (26%) or actively looking to switch to cheaper alternatives (34%). At the same time, the share of consumers reporting no change in behavior ticked up slightly, from 11% to 13%—suggesting some normalization, but with continued caution.

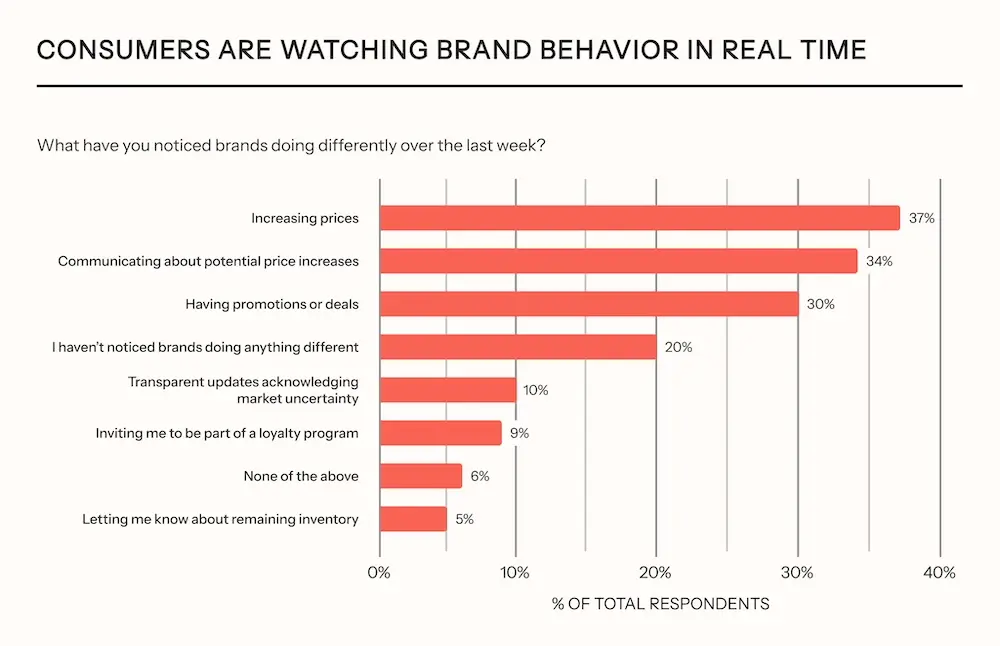

Your competitors are making moves—and consumers are noticing

Even so, shoppers are paying close attention to how brands respond: 80% of consumers have noticed brands taking some kind of action in the past week.

That includes price increases (37%), communication about potential hikes (34%), and new deals or promotions (30%). A smaller—but meaningful—group noticed brands offering loyalty perks (9%) and transparent updates about market conditions (10%).

Here’s why that matters: if your competitors are already communicating about the impact on their business, you can’t afford to be the brand that stays silent. Your customers are watching, and they’re using what they see to make spending decisions. Keeping tabs on peer brands, partners, and your own messaging cadence isn’t just smart marketing—it’s risk management.

This isn’t a sign to pull back. It’s a cue to get sharper

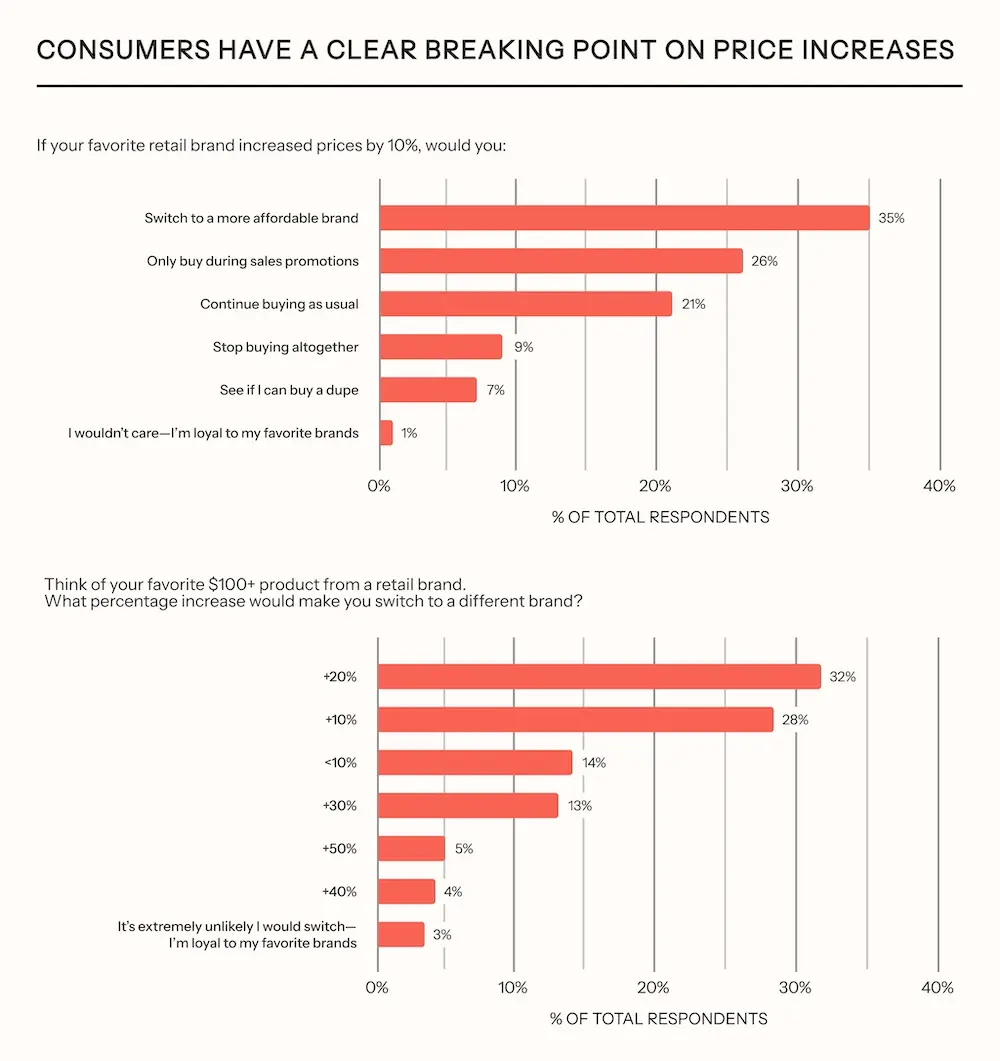

Price sensitivity is growing, yes, but consumers are still making luxury purchases. 35% of shoppers say they’d switch to a more affordable brand if their favorite increased prices by just 10%. But 21% say they’d keep buying as usual, and nearly 1 in 5 would still invest in luxury items—if the brand feels worth it.

That’s the opportunity. In today’s climate, price isn’t everything—perceived value is. And value isn’t just about discounts. It’s about trust, clarity, and the strength of your relationship.

What matters most to consumers right now?

It’s the same playbook we saw last week: consistent product quality (37%), personalized discounts (54%), and transparency around pricing and supply chain challenges (63%). These aren’t trends—they’re expectations. And Klaviyo helps you meet them.

This week, use your data to act with precision.

- Segment your audience by loyalty and price sensitivity.

- Test messaging that reassures, rather than just promoting.

- Run predictive flows that get ahead of drop-offs.

If you’re a Klaviyo customer, you’re already equipped with tools like RFM analysis, price drop automations, and campaign testing to move faster than the market shifts. And if you’re not? This is your reminder: marketing shouldn’t guess. It should guide.

In times of uncertainty, the brands that win won’t be the ones that shout the loudest. They’ll be the ones that listen hardest—and respond in kind. That’s what your customers are waiting for. Don’t make them wait too long.

We’ll be back next week with more signals from the road ahead. Until then: drive with intention.

Week of April 14: priorities are shifting—are your campaigns keeping up?

We just wrapped our latest consumer pulse check, and here’s what we’re seeing: shoppers aren’t shutting down—but they are thinking about shifting gears. They’re spending more intentionally, being choosier about who they buy from, and reassessing what loyalty means to them.

Restaurants may see the biggest pullback (61% of consumers say they’re planning to cut spending there), followed by apparel and travel. Even grocery spend is tightening. We expect these spending cuts are likely due to recent periods of high inflation and tariff conversations.

But let’s be clear: this is not performance data—it’s consumer sentiment. These responses are signals, not proof. Still, they’re worth listening to. What we do know: when consumers shop, they’re leaning into the brands they already trust.

That’s a window of opportunity for marketers—if you act on it.

If you’re a marketer, this is your moment to meet people where they are—and Klaviyo gives you the tools to do exactly that. Here’s what this week’s consumer survey found, and what to do about it.

- Consumers want deals—specifically from brands they trust. 54% of shoppers say discounts are key to brand loyalty. With Klaviyo segmentation, you can target price-sensitive shoppers with personalized discounts—without discounting across the board. Use price drop flows to automatically notify customers when items they’ve viewed go on sale.

- Loyalty is a competitive advantage. 28% of shoppers are sticking with brands they already love. Klaviyo helps you identify VIPs using RFM analysis and CLV metrics. Build loyalty automations that reward your best customers with early access, exclusive drops, or personalized thank-you notes.

- Shoppers expect transparency. 62% of shoppers want clarity around pricing. Don’t wait until changes hit to communicate. Send an email today explaining where your brand stands, and commit to sharing updates as they come. Klaviyo’s campaign builder makes it easy to segment and send those messages across email and SMS.

- Consumers aren’t cutting back yet—but they’re signaling caution. Especially if you’re in restaurants, apparel, or travel, now’s the time to double down on retention. Klaviyo’s win-back and post-purchase automations, powered by predictive analytics, help you re-engage high-value customers before they churn.

- Doing more with less starts with smarter segmentation. Klaviyo’s RFM modeling and customer insights help you understand who’s loyal, who’s at risk, and who needs attention now. Combined with lifecycle automation and predictive analytics, you can turn that insight into action—automatically.

- Think less founder speak, more data. In uncertain times, customers aren’t looking for empty reassurances. They want information they can trust. 62% say they want pricing transparency and updates, but only 14% say personal notes from founders resonate. That’s a clear signal: prioritize relevance over sentiment.

Consumers are adapting fast. But that doesn’t mean you’re at the mercy of the market. With the right insights and the right platform, you can build marketing that adapts just as quickly—and turns uncertainty into opportunity.

We’ll be back next week with fresh data. Until then, keep listening, keep optimizing, and keep putting your customers first.